Medicare 101.

Medicare 101

Choosing health insurance is no longer a one-time decision for most Medicare beneficiaries. Each year, insurance companies make changes to Medicare plans that can impact how much you pay out-of-pocket such as monthly premiums, deductibles, drug costs and provider or pharmacy networks. Given these yearly changes, it is a good idea to look at your current Medicare plan each year to make sure it still meets your healthcare requirements and offers access to the providers and services you want and need.

- You want to minimize the amount of money you spend on visits to the doctor and/or specialist

- Your medications are becoming more expensive

- You want to stay active and join a gym

- You’ve been diagnosed with a chronic condition, such as diabetes, COPD or congestive heart failure

- You could benefit from additional support services, such as transportation assistance

- You need coverage for dental, vision and hearing needs

What is Medicare?

Medicare is a federal health insurance program offered by the Centers for Medicare and Medicaid Services.

Who is eligible for Medicare?

- People who are 65 or older

- People with certain disabilities

- People with End-Stage Renal Disease (ESRD)

Those eligible for Medicare have several different options.

- Original Medicare Plan (Part A and Part B)

- Medicare Advantage Plan (Part C)

- Medicare Prescription Drug Plan (Part D)

What is Medicare Advantage?

Medicare Advantage plan is a single plan that combines Medicare Part A and Part B coverage and other health services such as prescription drug coverage. Medicare Advantage plans also offer additional benefits like dental and vision coverage—critical aspects of maintaining one’s overall health. These plans can also include transportation services to helps seniors run errands and get to medical visits. Furthermore, these plans may cover grocery or home meal delivery after hospitalization.

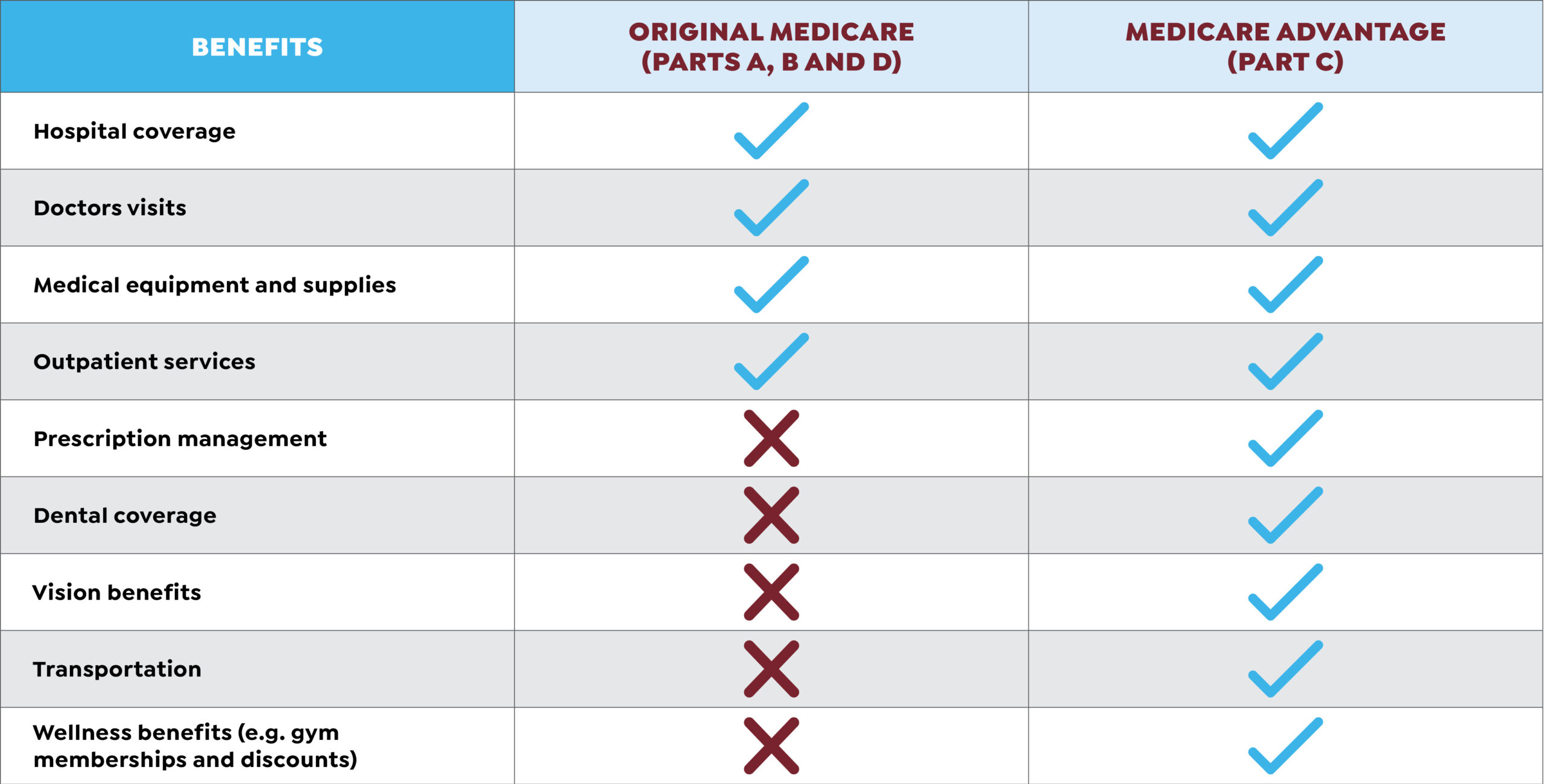

What's the difference between original Medicare and Medicare Advantage?

Original Medicare vs Medicare Advantage.

Not sure which plan works best for you. Take our quiz to find out.